Credit Control

You can now set credit limits on your contacts, meaning that this function will block an invoice being raised, if your customer has reached their credit limit. The invoice will instead be raised as a draft, but it won’t be approved or sent. This can be found in the edit section of the contact, under financial details.

Improvements to bank connections.

Open banking changed how we connected our software to our banks. With the change to new direct feeds, the biggest bugbear we heard from you, was that there was no ability to refresh the feed when you wanted to and add new statement lines at the push of a button. It was a complete pain when you had booked your admin day and it was still a day behind your bookkeeping or made it tricky to manage your credit control due to the delay in the statement lines coming through.

SO we’re happy to tell you that Xero has released an active refresh feature; this allows you to refresh a bank feed and then import the latest bank statement lines at any time. Exciting hey! What’s the catch? Unfortunately it is only available on certain banks;RBS, First Direct, NatWest, Lloyds, Barclays and MBNA

Xero is working closely with all the other banks though, and we hope more and more will come on board with this.

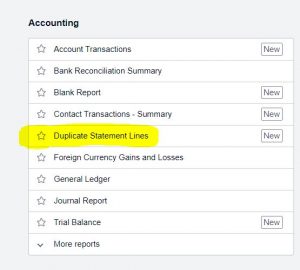

Duplicate Statement Lines

While it’s not often that it happens, it not unheard of for the banks to feed in duplicate statement lines. All though they can not prevent this from happening Xero has now introduced a “Duplicate statement line” report, which does as the title states and helps you identify duplicate statement lines. The report works by looking for a match in the date and amount field; if a match is found, the report takes a second step to look for a match on the reference or the payee fields, giving you a much higher accuracy level.

This is vital as it’s so important to always ensure your bank Xero matches your actual bank account total and we recommend you check this at the end of every month.